5-year variable-rate personal loans plunge more than half a point

[ad_1]

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

The latest trends in interest rates for personal loans from the Credible marketplace, updated weekly. (iStock)

Borrowers with good credit seeking personal loans during the past seven days prequalified for rates that were higher for 3-year and lower for 5-year fixed rates compared to the previous seven days.

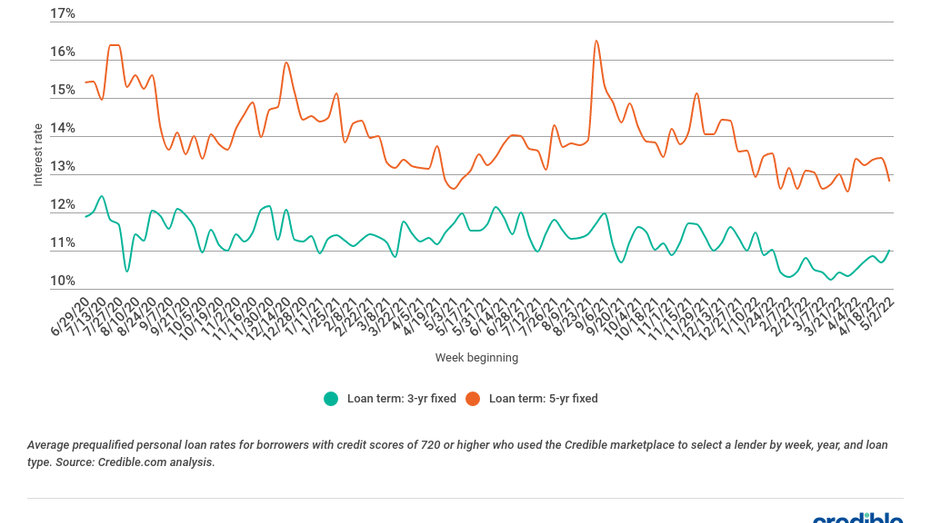

For borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender between May 2 and May 8:

- Rates on 3-year fixed-rate loans averaged 11.10%, up from 10.71% the seven days before and down from 11.72% a year ago.

- Rates on 5-year fixed-rate loans averaged 12.83%, down from 13.38% the previous seven days and up from 12.62% a year ago.

Personal loans have become a popular way to consolidate and pay off credit card debt and other loans. They can also be used to cover unexpected expenses like medical bills, take care of a major purchase or fund home improvement projects.

Rates for 3-year fixed personal loans rose over the past seven days, while rates for 5-year loans dropped. Rates for 3-year terms increased by 0.39%, and rates for 5-year terms fell by 0.55%. Despite this week’s increases, rates for 3-year fixed personal loans are lower today than this time last year. Borrowers can take advantage of interest savings with a 3-year or 5-year personal loan right now.

Whether a personal loan is right for you often depends on multiple factors, including what rate you can qualify for. Comparing multiple lenders and their rates could help ensure you get the best possible personal loan for your needs.

It’s always a good idea to comparison shop on sites like Credible to understand how much you qualify for and choose the best option for you.

Here are the latest trends in personal loan interest rates from the Credible marketplace, updated monthly.

Personal loan weekly rates trends

The chart above shows average prequalified rates for borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender.

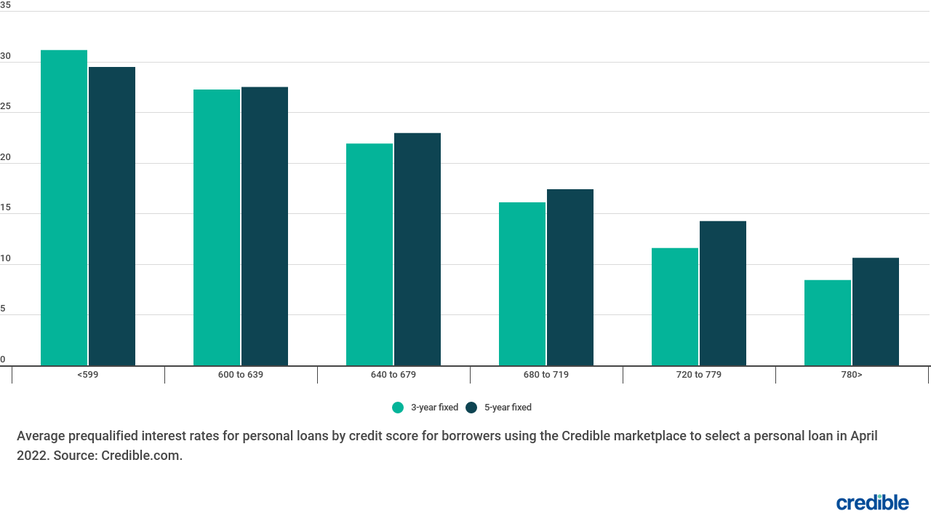

For the month of April 2022:

- Rates on 3-year personal loans averaged 10.69%, up from 10.36% in March.

- Rates on 5-year personal loans averaged 13.36%, up from 12.73% in March.

Rates on personal loans vary considerably by credit score and loan term. If you’re curious about what kind of personal loan rates you may qualify for, you can use an online tool like Credible to compare options from different private lenders. Checking your rates won’t affect your credit score.

All Credible marketplace lenders offer fixed-rate loans at competitive rates. Because lenders use different methods to evaluate borrowers, it’s a good idea to request personal loan rates from multiple lenders so you can compare your options.

Current personal loan rates by credit score

In April, the average prequalified rate sele

cted by borrowers was:

- 8.42% for borrowers with credit scores of 780 or above choosing a 3-year loan

- 29.46% for borrowers with credit scores below 600 choosing a 5-year loan

Depending on factors such as your credit score, which type of personal loan you’re seeking and the loan repayment term, the interest rate can differ.

As shown in the chart above, a good credit score can mean a lower interest rate, and rates tend to be higher on loans with fixed interest rates and longer repayment terms.

How to get a lower interest rate

Many factors influence the interest rate a lender might offer you on a personal loan. But you can take some steps to boost your chances of getting a lower interest rate. Here are some tactics to try.

Increase credit score

Generally, people with higher credit scores qualify for lower interest rates. Steps that can help you improve your credit score over time include:

- Pay bills on time. Payment history is the most important factor in your credit score. Pay all your bills on time for the amount due.

- Check your credit report. Look at your credit report to ensure there are no errors on it. If you find errors, dispute them with the credit bureau.

- Lower your credit utilization ratio. Paying down credit card debt can improve this important credit scoring factor.

- Avoid opening new credit accounts. Only apply for and open credit accounts you actually need. Too many hard inquiries on your credit report in a short amount of time could lower your credit score.

Choose a shorter loan term

Personal loan repayment terms can vary from one to several years. Generally, shorter terms come with lower interest rates, since the lender’s money is at risk for a shorter period of time.

If your financial situation allows, applying for a shorter term could help you score a lower interest rate. Keep in mind the shorter term doesn’t just benefit the lender — by choosing a shorter repayment term, you’ll pay less interest over the life of the loan.

Get a cosigner

You may be familiar with the concept of a cosigner if you have student loans. If your credit isn’t good enough to qualify for the best personal loan interest rates, finding a cosigner with good credit could help you secure a lower interest rate.

Just remember, if you default on the loan, your cosigner will be on the hook to repay it. And cosigning for a loan could also affect their credit score.

Compare rates from different lenders

Before applying for a personal loan, it’s a good idea to shop around and compare offers from several different lenders to get the lowest rates. Online lenders typically offer the most competitive rates – and can be quicker to disburse your loan than a brick-and-mortar establishment.

But don’t worry, comparing rates and terms doesn’t have to be a time-consuming process.

Credible makes it easy. Just enter how much you want to borrow and you’ll be able to compare multiple lenders to choose the one that makes the most sense for you.

About Credible

Credible is a multi-lender marketplace that empowers consumers to discover financial products that are the best fit for their unique circumstances. Credible’s integrations with leading lenders and credit bureaus allow consumers to quickly compare accurate, personalized loan options ― without putting their personal information at risk or affecting their credit score. The Credible marketplace provides an unrivaled customer experience, as reflected by over 4,500 positive Trustpilot reviews and a TrustScore of 4.7/5.

[ad_2]

Source link