Understanding Smarter Spending

In the modern financial landscape, knowing how to allocate funds effectively is crucial for both individuals and businesses. Smarter spending insights provided by accountants empower you to make informed choices, avoid unnecessary expenses, and maximize the value of every dollar. From daily budgeting to strategic investment decisions, understanding where and how money flows is the cornerstone of financial success.

The Role of Accountants in Savings

Accountants bring a wealth of expertise to the table, guiding clients toward accountants saving advice that is practical and actionable. By analyzing spending patterns and identifying hidden costs, they help streamline financial habits. This goes beyond mere cost-cutting—it’s about optimizing spending to align with long-term objectives, ensuring that financial resources support both stability and growth.

Finance Optimization Strategies

Optimizing finances requires a structured approach, and accountants provide finance optimization tips that can revolutionize money management. Techniques such as prioritizing high-impact expenditures, leveraging tax efficiencies, and monitoring cash flow allow for smarter decision-making. With their guidance, both individuals and organizations can reduce waste, enhance liquidity, and invest in areas that generate the greatest returns.

Creating a Spending Plan That Works

A well-crafted spending plan is essential for achieving financial goals. Accountants can help create tailored budgets that reflect income, expenses, and future priorities. By incorporating money management insights, they offer strategies for managing discretionary spending without sacrificing lifestyle quality. This balance between prudence and flexibility ensures that spending decisions are intentional and sustainable.

Monitoring and Adjusting Financial Habits

Consistent monitoring is key to smarter spending. Accountants recommend regular financial reviews to evaluate how money is being used and to adjust plans accordingly. Using tools such as automated tracking software and customized reporting, clients gain clear visibility into their finances. This ongoing process allows for immediate corrections, preventing small inefficiencies from escalating into larger financial challenges.

Reducing Unnecessary Expenditures

Identifying nonessential costs is a fundamental step in optimizing spending. Through detailed analysis, accountants uncover areas where expenditures can be minimized without compromising quality or productivity. Implementing these changes translates into tangible savings, freeing up capital for investments, emergency funds, or strategic growth initiatives.

Leveraging Tax and Legal Advantages

Intelligent spending also involves understanding tax implications and legal opportunities. Accountants provide insights into deductions, credits, and business structures that can reduce liabilities. By incorporating smarter spending insights into tax planning, individuals and businesses can retain more of their earnings while remaining fully compliant with regulations.

Strategic Investment Decisions

Smarter spending is not only about cutting costs; it is also about deploying funds strategically. Accountants advise on investments that offer optimal returns relative to risk. They consider both short-term liquidity needs and long-term growth objectives, ensuring that money is allocated efficiently. This approach transforms routine financial decisions into deliberate strategies that enhance wealth accumulation.

Enhancing Business Efficiency

For businesses, accountants saving advice extends to operational expenses. From inventory management to vendor negotiations, accountants help organizations streamline processes and identify cost-saving opportunities. By aligning spending with strategic priorities, companies can improve profitability without compromising service quality or employee satisfaction.

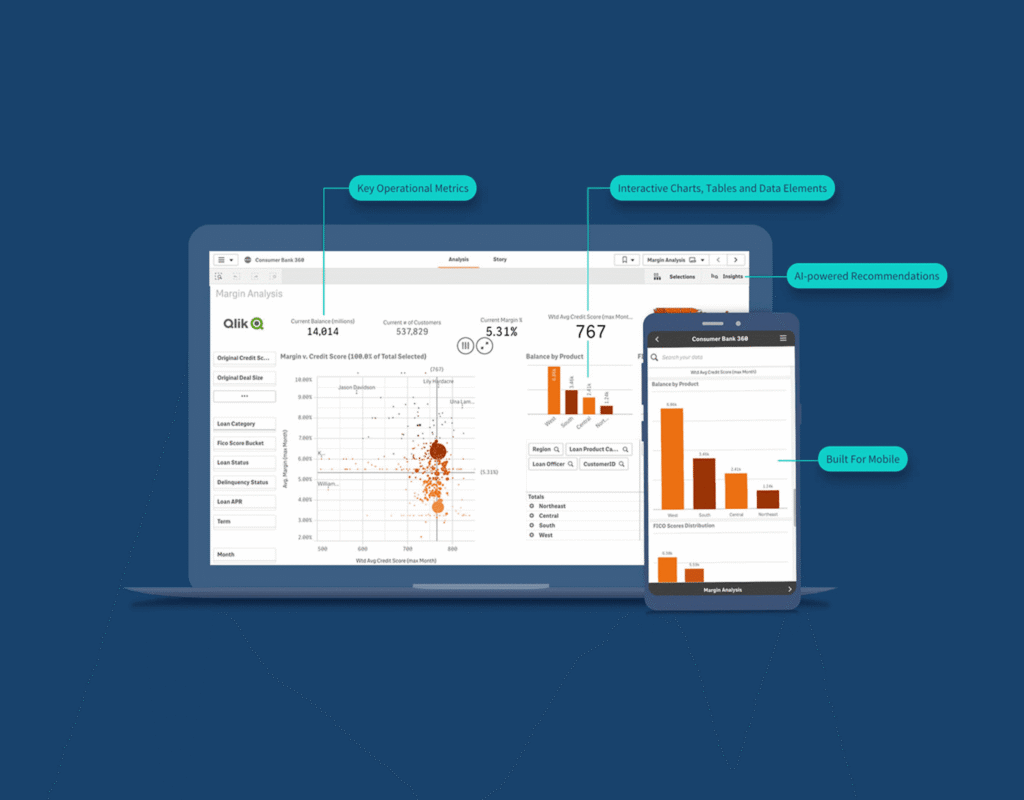

Utilizing Technology for Financial Management

Modern financial tools enable smarter spending through real-time tracking, predictive analytics, and automated alerts. Accountants integrate these technologies into their guidance, offering finance optimization tips enhanced by data-driven insights. This combination of human expertise and technological efficiency ensures spending decisions are precise, timely, and impactful.

Encouraging Responsible Consumer Behavior

Smarter spending also encompasses personal habits. Accountants provide guidance on lifestyle choices, debt management, and savings strategies that foster financial responsibility. By following money management insights, individuals can cultivate habits that prevent overspending, reduce stress, and promote financial independence.

Preparing for Future Financial Challenges

Anticipating future expenses is critical to maintaining stability. Accountants help clients develop contingency plans and emergency funds, ensuring that unexpected events do not derail financial goals. Strategic budgeting informed by professional insights prepares individuals and organizations to weather uncertainties without sacrificing progress.

Building Long-Term Financial Health

Ultimately, smarter spending insights from accountants are about creating sustainable financial health. By combining prudent budgeting, optimized investment strategies, and continuous monitoring, individuals and businesses can achieve both immediate savings and long-term growth. The guidance provided empowers clients to make confident decisions, maintain financial flexibility, and pursue opportunities without undue risk.

More Stories

The Hidden Power of Great Accountants

Why Businesses Rely on Accountants Daily

Accountants Tips for Smarter Investing