How the Fed’s Rate Increase Will Impact Your Personal Finances

[ad_1]

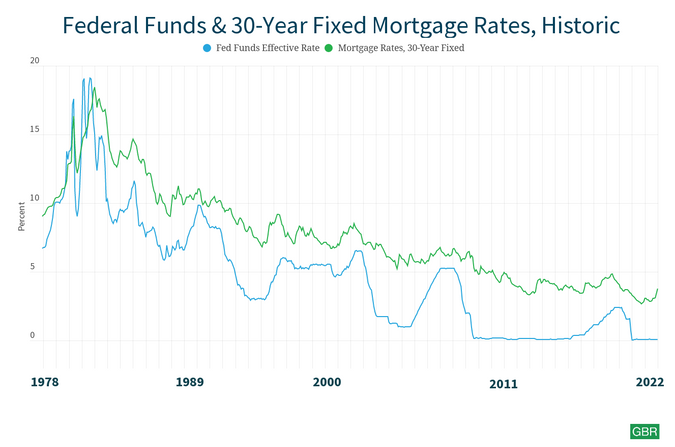

The Federal Reserve Board of Governors raised critical desire prices .25% details on March 16 for the 1st time in 3 a long time, just as Russia’s widely condemned invasion of Ukraine upset global power marketplaces already weakened by the COVID-19 pandemic.

See: Tesla Hikes Rates as Musk States There is ‘Inflation Stress on Raw Materials’

Find: Are Bonds Still a Harmless Investment decision In the course of Inflation?

In context, the benchmark interest amount boost arrives only two many years after the central lender slashed rates to in close proximity to-zero to simplicity the financial pain induced by the COVID-19 pandemic.

On the countrywide fascination stage, a healthful knowing of how rate boosts will impression the financial foreseeable future sectors is superior to know. But being aware of how these charge hikes will impression your individual money outlook and information private plans of action is downright significant.

All people is experiencing the outcomes of soaring housing, foodstuff and energy rates and will keep on to see all those rise and fluctuate. But how will the Fed price hike influence your individual funds on points like credit history playing cards, home loans, traces of credit and savings accounts? Let us just take a appear.

Credit Cards

As significantly as your credit history cards are anxious, hope to see an influx of helpful e-mailouts and texts to your inboxes and phones about the upcoming though due to the fact the new amount increases will impact your beloved plastics. In accordance to CreditCards.com, credit rating cards average for the week of March 9 is 16.17% with an total ordinary hovering around 16%. Reward credit history cards operate a little bit higher at a 17.51% typical — up from 16.99% just a month ago. These will enhance the moment the Fed announcement is produced.

Mortgages and House Equity Strains of Credit

Both adjustable- and preset-amount home loans, and house equity strains of credit (HELOC), will be affected by the benchmark fee hike, but only marginally. Adjustable-rate home loans are modified immediately after the 1st fixed-charge time period ends (usually right after 5 years). If that mounted time period has stopped, assume to pay back an additional $187 per thirty day period on a $300,000 adjustable mortgage, at the finish of a calendar year of 5 .25%-position Fed raises. The anticipated amount maximize is a short-term borrowing approach, and a preset mortgage is a lengthy-time period monetary project, so these premiums will not cause way too a lot of a fiscal stress in the here and now. But the recent mounted mortgage rate rose somewhere around a person major proportion place considering that November and presently sits right around 3.85%, according to home financial loan mortgages professionals Freddie Mac. Appropriately, payment on a $300,000 house loan will be around $1,719.

For house equity lines of credit, you should really hope to fork out an supplemental $6.00 per thirty day period from the quarter-stage enhance on a $30,000 line of credit at the regular 3.96% normal amount.

Car Loans

Now is not the finest time to buy a automobile as selling prices have increased substantially in excess of the previous year owing to provide chain disruptions. But present car or truck financial loans will not be influenced greatly, you could most likely see a $3.00 boost in your monthly payment maximize on a automobile valued at $25,000.

Discounts Accounts and CDs

Looking at how little personal savings and CD premiums are correct now (hovering all around .06% and .14% respectively) and how slow deposits answer to interest amount raises, the Fed price increase should not advantage savers significantly. A keener eye really should be kept on online banking institutions, having said that, as they are trickier to forecast owing to their fluctuating and competitive nature.

What Can You Do?

For credit history card hoarders, now may well be a great time to spend off financial debt or consolidate it into a financial loan with decrease preset month-to-month charges. You could participate in the equilibrium transfer game as nicely, if you can find an possibility that will have you having to pay % interest when you pay out off the equilibrium. Locking into fees for home loans and vehicle financial loans make ease monetary pressure ahead of premiums enhance to an uncomfortable or unpayable stage. As often, bolstering any feasible crisis resources would be a intelligent strategy now too.

See: Preserve Income on Your Electric powered Invoice As Prices Climb — Here’s How To Prep for Hotter Weather

Obtain: 10 Concealed Expenditures of Obtaining a Dwelling

At 1st look, a large amount of these economical impacts don’t feel far too costly at all. But continuing increases in gas, groceries and rent, coupled with any additional funds out of your pocket and into the bank, will hit most individuals more difficult than they think, especially for those currently having difficulties with their finances because of to the pandemic.

Additional From GOBankingRates

This posting at first appeared on GOBankingRates.com: How the Fed’s Level Raise Will Influence Your Own Funds

[ad_2]

Source hyperlink